Ultra-low voltage motor, motor drive industry growth driven by mobile robotics, increased flexibility

Control Engineering

SEPTEMBER 12, 2023

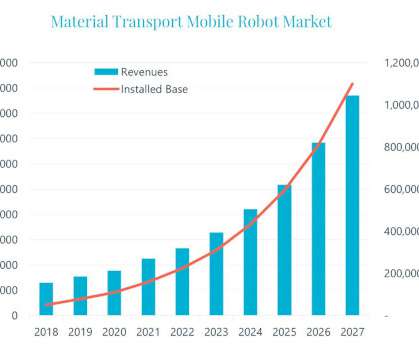

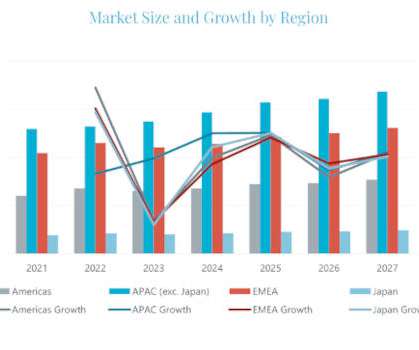

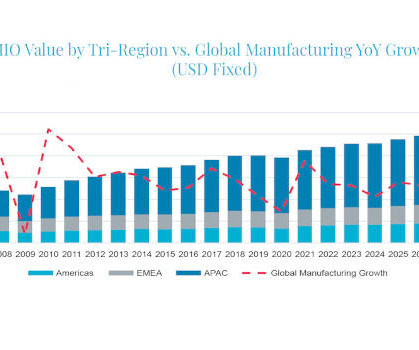

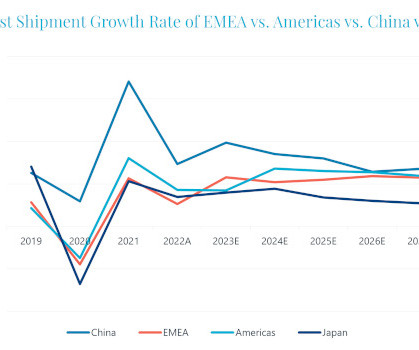

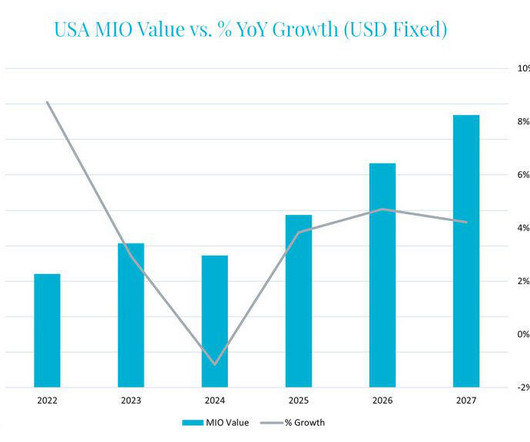

billion by 2027, driven by demand from battery-driven applications and increased flexibility in manufacturing and logistics processes. Mobile robots are expected to account for a significant portion of the market by 2027. By 2027, the ultra-low voltage motor market will be worth almost $6.5 between 2022 and 2027.

Let's personalize your content